HAPPENINGS AT THE STI

|

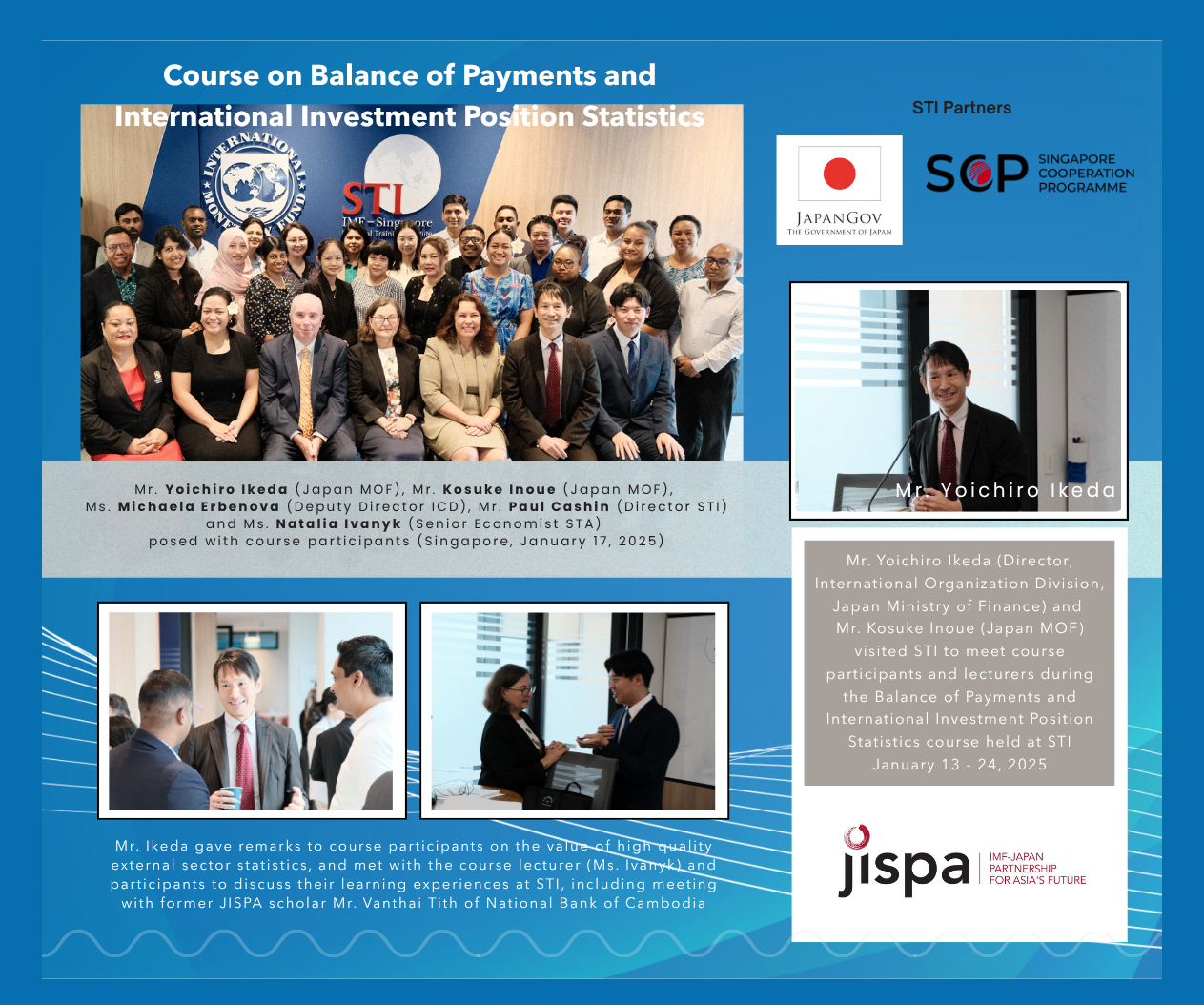

| (January 13 - 24, 2025) |

|

Should central banks offer new forms of money? This was the central question of a one-week course on central bank digital currency (CBDC)—a widely accessible digital form of fiat money that could be legal tender. Thirty officials from central banks, ministries of finance, and AMRO learned about a conceptual framework to assess the case for CBDC adoption from the perspectives of users and central banks. The course focused on possible CBDC designs, potential benefits and costs, cross-border considerations, and the impacts on monetary policy, financial stability, and inclusion. Participants commented: “The best thing about the training was that it started from the basics and developed our understanding to comprehend complex concepts.” “I rated most of the sessions as ‘Strongly Agree’ because they provided in-depth knowledge on CBDCs, covering motivations, design, benefits, risks, and regulatory considerations, which are highly relevant to my role as a supervisor overseeing deposit-taking institutions.” “The case studies were particularly useful in understanding real-world applications of CBDCs.” (March 21, 2025) |

|

Selected issues in the evolving financial regulatory framework Thirty officials from central banks, a securities commission, and a ministry of finance and planning from 16 Asia and Pacific countries learned about key aspects of the prudential regulatory framework for banks, lessons from previous financial stability threats, and regulatory measures to mitigate banking risks. Topics included Basel III capital requirements—including the countercyclical capital buffer—systemically important banks, leverage and liquidity requirements, macroprudential policies, regulatory challenges around fintech, and ongoing international regulatory discussions. Participants commented: “This course is really beneficial for me since I learned many new concepts I previously had doubts about. I would recommend having this course again in the future so that I can encourage my colleagues to apply.” “Working through the case studies after the lectures, as well as the country presentations, was extremely helpful and valuable. They provided practical insights and deepened my understanding of the material.” “The session on macroprudential policies was very helpful in understanding how financial stability is maintained through regulatory measures.” (March 14, 2025) |

|

Course on Managing Capital Flows (MCF) successfully concludes in Singapore International capital flows—such as foreign direct investment, portfolio investment, and cross-border bank lending—can have great economic benefits by bringing in foreign capital, technology, and market access, and contributing to the depth and sophistication of domestic financial systems. However, the inflow of foreign capital can also create vulnerabilities in the domestic financial system, potentially setting up a future crisis. In this two-week course, 30 officials from 17 Asia-Pacific countries learned how to access and analyze capital flow data. Participants also explored lessons from theory and experience on the correct sequencing of capital account liberalization and the proper use of macroprudential measures (MPMs) and capital flow measures (CFMs) to mitigate risk. Participants’ comments: “As an analyst in the department, I will integrate this knowledge into the policy design process, particularly considering the current dynamic situation in my country, where adequate policies/measures are critical. Additionally, I will lead knowledge-sharing sessions within the department to ensure a broader understanding of these concepts and tools.” “Prior to attending this training module, I was unfamiliar with the subject and had only a basic comprehension of it. However, during the training module, I not only acquired the fundamentals, but also became acquainted with the most recent tools that will allow me to perform my job efficiently. We haven't fully opened our capital account yet, but the tools and concepts I've learnt will allow me to develop capital account policies while considering the accompanying risks. Throughout the course, the instructors did an excellent job of giving an appropriate balance of key concepts and applications.” “It was a good course with practical insights. Capital flows are backed by a web of complex mechanisms. This course provided clarity on many of these underlying aspects through its effective design, encompassing detailed lectures and workshops.” (March 7, 2025) |

Course on Managing Capital Flows (MCF) successfully concludes in Singapore International capital flows—such as foreign direct investment, portfolio investment, and cross-border bank lending—can have great economic benefits by bringing in foreign capital, technology, and market access, and contributing to the depth and sophistication of domestic financial systems. However, the inflow of foreign capital can also create vulnerabilities in the domestic financial system, potentially setting up a future crisis. In this two-week course, 30 officials from 17 Asia-Pacific countries learned how to access and analyze capital flow data. Participants also explored lessons from theory and experience on the correct sequencing of capital account liberalization and the proper use of macroprudential measures (MPMs) and capital flow measures (CFMs) to mitigate risk. Participants’ comments: “As an analyst in the department, I will integrate this knowledge into the policy design process, particularly considering the current dynamic situation in my country, where adequate policies/measures are critical. Additionally, I will lead knowledge-sharing sessions within the department to ensure a broader understanding of these concepts and tools.” “Prior to attending this training module, I was unfamiliar with the subject and had only a basic comprehension of it. However, during the training module, I not only acquired the fundamentals, but also became acquainted with the most recent tools that will allow me to perform my job efficiently. We haven't fully opened our capital account yet, but the tools and concepts I've learnt will allow me to develop capital account policies while considering the accompanying risks. Throughout the course, the instructors did an excellent job of giving an appropriate balance of key concepts and applications.” “It was a good course with practical insights. Capital flows are backed by a web of complex mechanisms. This course provided clarity on many of these underlying aspects through its effective design, encompassing detailed lectures and workshops.” (February 21, 2025) |

|

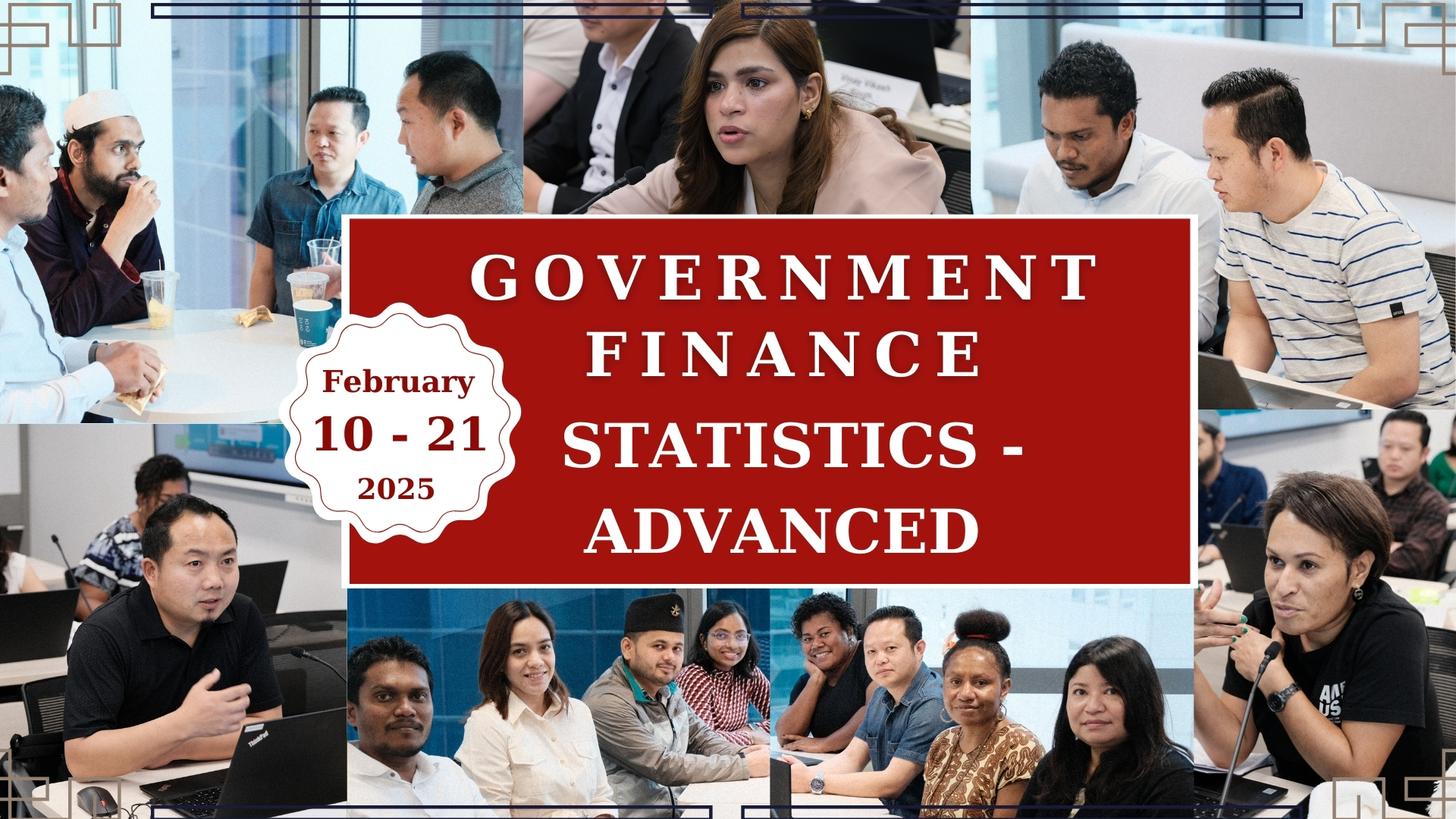

Government finance statistics (GFS)—a coherent, consistent, and integrated framework to capture fiscal activity Twenty-eight officials from ministries of finance, treasuries, statistics offices, central banks, offices of the prime minister and the comptroller and auditor general, and a tax administration from 18 Asia and Pacific countries learned about complex GFS methodological and compilation issues. Officials commented: “The discussions on borderline issues were very helpful as this is an advanced course.” “Sometimes the exercise doesn't give a black and white answer but gives a gray answer. It's fun, because it opens up my perspective—and in reality, it's like that.” “Hands-on sessions reinforce learnings and connect them with actual practice.” “Revenue & expenditure, compiling of GFS, PPPs (public-private partnerships), consolidation—these were topics I learned a lot from.” “The sessions on overview of the GFS Framework, COFOG (Classification of the Functions of Government), and the GFS compilation process were helpful.” (January 21, 2025) |

The inaugural Blended Macroeconomic Policy Communication course Thirty participants from 14 countries learned communication strategies and tools to enhance clarity and transparency in policy messaging. They practiced drafting press releases and delivering comprehensive policy communication packages, while leveraging AI tools. The fast-paced, interactive course challenged them with several “surprise” developments to which they had to react quickly. This new course was jointly developed by staff of the IMF’s Institute for Capacity Development and Communication Department. The Institute’s Deputy Director, Michaela Erbenová, kicked off the course and delivered the first lecture. (January 24, 2025) |

|

Exchange Rate Policy (ERP) course concludes successfully at STI Taking participants through the different types of exchange rate regimes, the two-week ERP course provided a basis for understanding exchange rate (ER) regime suitability according to country characteristics and phase of development, as well as lessons for transitions from fixed to flexible regimes. In addition to theoretical analysis and empirical findings, the course included an overview of some of the tools used by the IMF to examine countries’ external sectors, such as assessing reserve adequacy (ARA) and external balance assessment (EBA). Moreover, the course covered early warning systems (EWS) for currency crises and lessons from the Integrated Policy Framework (IPF) used by the IMF. Some twenty-nine officials from thirteen Asia-Pacific countries (mostly central banks) attended the course. Participants’ comments: “I have improved my knowledge in exchange rate regimes, FX interventions, EBA and ER policies, and many practical aspects. I will use the knowledge gained in FX interventions since I’m currently engaged in work related to FX interventions.” “I am planning to improve my work on FX operations and research analysis. I will calculate EWS and EBA based on my country's data. Also, I will share this program's knowledge and practice with my colleagues, and explore IMF’s research papers.” “The knowledge and skills/tools on EBA and ARA metrics will help in improving our dialogue with the IMF Article IV Mission, as well as with the Monetary Policy Committee. The knowledge and skills acquired from this course will also help me provide useful input to better calibrate the QPM model for my country. Furthermore, given a smaller open economy susceptible to external crisis, the EWS is a useful tool which can be built into the economic analysis and policy advice.” (December 13, 2024) |

|

Course on Legal Aspects of International Financial Institutions (IFIs) Twenty-nine central bankers, financial regulators, and ministries of finance officials from 15 Asia and Pacific countries completed this one-week training. It was presented by lawyers from the IMF Legal Department, the World Bank Group, and the Asian Development Bank, and covered legal, institutional, and operational features of IFIs. Participants commented: “This course helped in understanding the recent thinking and developments in multilateral organizations and will enhance our ability to better negotiate and interact with these organizations.” “The legal aspects of the governance structure of each IFI were helpful in better understanding how they operate.” “I particularly liked the session on the IMF and its legal aspects and how it does the lending to its member countries.” (December 6, 2024) |

|

Stress testing has become essential to financial stability analysis. Twenty-nine officials from central banks, ministries of finance, financial regulators, AMRO, and an IMF resident representative office from 19 Asia and Pacific countries learned about the design of stress testing tools, including climate risk analysis. Stress tests are forward-looking exercises to evaluate the impacts of severe but plausible adverse scenarios on the resilience of financial institutions and the financial system. Participants commented: “I really appreciate the template provided for the workshop, which is very useful and relevant for my work.” “Application of R was really great, and the different Excel-based exercises helped develop data analysis efficiency.” “The session on satellite models and scenario modelling was very useful.” (November 29, 2024) |

|

Twenty-eight officials from 17 Asian and Pacific countries participated in the IMF's flagship Financial Programming and Policies course. Participants explored the interlinkages between economic sectors and learned how to develop comprehensive and consistent macroeconomic forecasts. A notable first for the STI was the IMF program negotiation simulation, where participants role-played negotiations between the IMF and national authorities. Feedback from participants: “The tools will help me improve policy advice and facilitate better dialogues with international stakeholders. Additionally, I will share my learnings from this wonderful training with my colleagues back at the Ministry who will love this.” “...We'll make use of this FPP for our discussions with the IMF review mission. It will be used to guide us while setting targets for next financial year, both for real and monetary sectors.” “The course was highly relevant to my work, providing practical tools and frameworks that we use on a regular basis at the Ministry…” (November 22, 2024) |

|

Advanced statistical methods for central banking implementation Twenty-eight central bankers from 14 Asia and Pacific countries learned about advanced statistical methods for central banking implementation. Methods included estimation and implementation of foreign exchange intervention rules based on a risk approach and forecasting systemic liquidity in the context of different operational frameworks. Participants’ comments: “All the sessions were enriching and well structured, starting from the basics to implementation with advanced tools like R and Jupyter Notebook.” “The lecture on the statistical methodologies is the most useful, as the understanding helps us to adapt the toolbox ourselves in the future.” “As our central bank does not do liquidity forecasting currently, we will be able to implement it once we are back in our country.” (November 15, 2024) |

|

Information about sectoral balance sheets is most useful, allowing policymakers to identify and correct weaknesses before they contribute to financial difficulties. Twenty-nine statisticians, central bankers, and officials from ministries of finance and a state administration of foreign exchange from 17 Asia and Pacific countries learned about a Balance Sheet Approach (BSA). BSA is a systematic analytical framework for exploring how balance sheet weaknesses contribute to the origin and propagation of modern-day financial crises. The course provided an overview of the concepts underlying the methodology for compilation, source data, and analytical use of the BSA matrix. Participants’ comments: “The course showed me the importance of the source data and that I would need to expand my data coverage so that we could have a clear data analysis of our country's economy.” “The explanation of the MFS (monetary financial statistics), IIP (international investment position), GFS (government finance statistics) data and how to map them into the BSA matrix is very useful for me.” “The vulnerability analysis was especially helpful.” “Since I am from the Ministry of Finance, I do not know much about MFS or IIP. All the sessions helped me get a better understanding of those and get to understand the linkage between all the data.” (November 8, 2024) |

|

How to harness the benefits and opportunities of Fintech while managing associated risks? This was the central question of a two-week course that included two days at the Singapore FinTech Festival. Twenty-nine regulators, central bankers, and ministry of finance officials from 14 Asia and Pacific countries gained a foundational understanding of new financial technologies (fintech) and associated policy implications. Fintech is accelerating change in the financial sector by leveraging the explosion of big data, advances in artificial intelligence, computing power, cryptography, and the reach of the internet. Participant comment: “As a regulator we have to be very conscious about innovation and fintech. New innovation and fintech enhance the efficiency of payment systems, lending and borrowing activities, financial intermediaries, and overall the economy. It also increases financial inclusion. However, there might be different risks such as financial stability risk, liquidity risk, concentration risk, monetary sovereignty risk in cross-border payments, lack of customer protection, data management risk, cyber security risk, and various operational risks involved in fintech. I will use all of these insights I got during the course in my regulatory capacities.” (November 8, 2024) |

|

A new course “Transforming Public Finance Through GovTech” was well received. GovTech is the use of technology to modernize government operations and service delivery. Twenty-nine officials from 15 countries assessed digital development and adoption by households, businesses, and governments in the Asia and Pacific region. They learned about the potential for GovTech to transform public services and enhance efficiency, transparency, and inclusiveness. Participants commented: “I really like how the cases of many countries were raised.” “The sessions on assessing the digital environment, costing digital infrastructure, social divide, and PFM (public financial management) enhanced my knowledge a lot. There were lots of new concepts which I learned through this course, and even some initiatives in our country which I didn't know about.” “I really like the framework of costing digitalization infrastructure. It's very practical and useful for our daily office life.” (October 25, 2024) |

|

Workshop on the Sovereign Risk and Debt Sustainability Framework (SRDSF) for Market Access Countries Twenty-two officials from central banks, ministries of finance, the World Bank, and the Singapore Regional Training Institute learned about the IMF’s new SRDSF. The framework is designed to help guide countries’ borrowing decisions, assess their vulnerability to sovereign debt-related stress, and identify policies to prevent and manage public debt-related stress. Participants commented: “All of the topics were helpful as this is a new framework for sovereign risk assessment and debt sustainability.” “SRDSF is a very comprehensive framework to analyse debt sustainability.” “The discussion of the course was really comprehensive. I highly appreciate the insights exchanged throughout the duration of the course, especially hearing from the creditor and assessor's side (IMF) and our fellow sovereigns.” “The session about ‘Realism Tools’ captured my attention the most.” (October 18, 2024) |

|

Climate in Macroeconomic Frameworks course first delivery in STI Climate in Macro-Frameworks (CMF) is a new IMF one-week course designed to assist governments—mostly central banks and ministries of finance—in integrating climate risk into their macroeconomic forecasts and frameworks. The course was delivered for the first time in STI to a group of 28 officials from 17 countries. CMF is centered around three core tools illustrating the economic implications of climate-related risk: the Climate Macro-Framework Tool (CMT), the Debt Dynamics Tool with Natural Disasters (ND DDT), and the DIGNAD model. The course was very hands-on, with participants engaging directly with the tools and adapting them to different scenarios. Participants’ comments: “I have learnt so many new things and acquired new knowledge on CMT, ND_DDT, and DIGNAD Model even though I had attended the DDT course online. This training was definitely insightful beyond my imagination. I am now well equipped with dealing models and will try to apply my knowledge to prepare policy decisions.” “Besides the informative lectures on climate change and macroeconomics, group work and presentations really helped us learn from each other, study scenarios, and build stories so that we could relate them to the outcomes from the simulations. Since lectures and workshops were done simultaneously, it helped to understand concepts both theoretically and practically.” “This week’s training was 100% effective in enhancing my knowledge. It will be useful in my job. Back home, we have very limited models to assist us, and attending this course for the first time was worthwhile. The method of grouping us for discussions and joint presentations enabled us to engage further with our respective counselors on the model and explore our individual issues. However, I feel that one week is not sufficient for me to fully absorb all the details of the model, which would be important to consider for the next batch.” (October 18, 2024) |

|

Financial market infrastructures play a critical role in the financial system and broader economy. Twenty-nine officials from 17 Asia and Pacific central banks and financial regulators learned about principles for financial market infrastructures to enhance safety and efficiency in payment, clearing, settlement, and recording arrangements. More broadly, the training aimed to limit systemic risk and foster transparency and financial stability. Participants commented: “The course objective is to support our current work on self-assessment in country.” “The case study made me better understand RTGS (real-time gross settlement) and CDS/SSS (central securities depository/securities settlement system).” “Operational risk management on payment systems is interesting.” (October 11, 2024) |

|

Participants from the Monetary Policy Course @STI gave three impressive presentations which showed they had truly internalized their learning. It was rewarding to see their transformation! Participants enjoyed ten days of lectures and workshops, two guest speeches, a visit to the Monetary Authority of Singapore currency gallery, and the course jeopardy game. A quote from one of the participants: “The course is well-arranged, as not only does it dive into the basics of monetary policy and distinctions in policy response in different regimes, but it also allows participants to actually have hands-on experience in modelling shock scenarios, which is really useful when it comes to actual work. Additionally, the case study provides better insight into how history played out, and therefore one could learn both from the success and failure.” (September 13, 2024) |

|

Participants from the Monetary Policy Course @STI gave three impressive presentations which showed they had truly internalized their learning. It was rewarding to see their transformation! Participants enjoyed ten days of lectures and workshops, two guest speeches, a visit to the Monetary Authority of Singapore currency gallery, and the course jeopardy game. A quote from one of the participants: “The course is well-arranged, as not only does it dive into the basics of monetary policy and distinctions in policy response in different regimes, but it also allows participants to actually have hands-on experience in modelling shock scenarios, which is really useful when it comes to actual work. Additionally, the case study provides better insight into how history played out, and therefore one could learn both from the success and failure.” (September 13, 2024) |

|

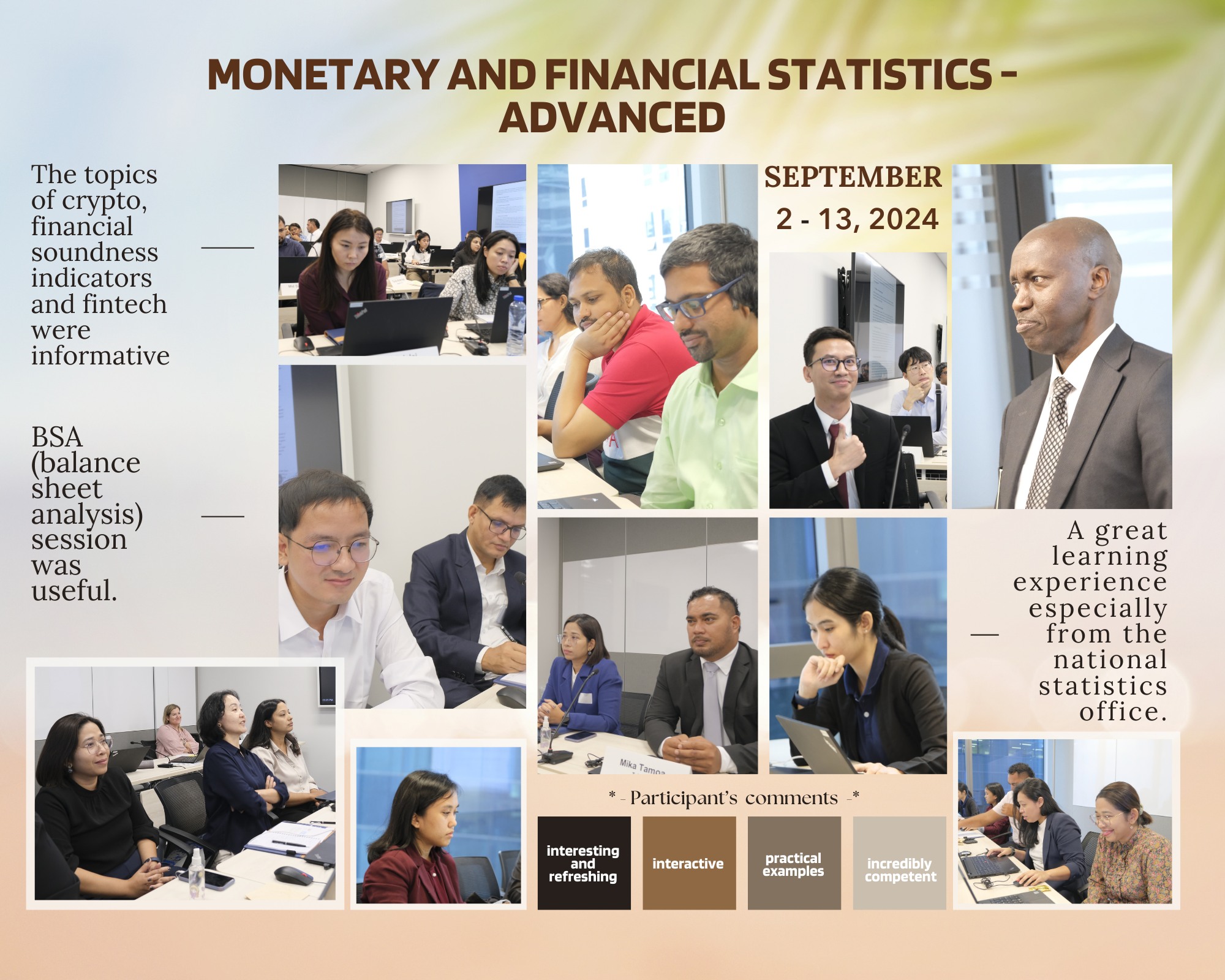

Monetary and financial statistics are crucial for economic and financial policies and analyses. Twenty-eight officials from 17 Asia and Pacific nations, including Tokelau—STI’s newest member—learned about the compilation of monetary and financial statistics. The advanced training focused on other financial corporations (OFCs), such as insurance corporations, pension funds, and non-money market funds. (September 13, 2024) |

|

Reform of insolvency systems can play a major role in strengthening a country’s economic and financial system. Twenty-six officials from 11 Asian countries shared their experience with corporate and household insolvency law reform and implementation, enforcement of claims, and alternative techniques for the treatment of distressed debt. The workshop was hosted by the Singapore Regional Training Institute and presented by the IMF Legal Department. Participants commented: “I am delighted with the workshop content and learning methodologies.” “Great topics that provide the opportunity to learn about practices, regulations, and challenges of other countries.” “The hypothetical case studies allowed participants to bring in scenarios applicable to their own jurisdiction for discussion.” (July 24, 2024) |

|

A unified framework for the use of multiple tools in the pursuit of macroeconomic and financial stability objectives Nineteen central bankers from nine Asian countries learned about the IMF’s Quantitative Model for the Integrated Policy Framework and how it can be applied to address policy questions. The Integrated Policy Framework (IPF) is an approach that considers the joint role of monetary, exchange rate, macroprudential, and capital flow management policies. Participants commented: “One of the best workshops in terms of how much I learnt, honestly.” “The workshops were particularly helpful in understanding the model. The scenario we did on the impact of mixing policies will help us in our future policy recommendations.” (July 19, 2024) |

|

Fiscal risks can be sizeable, and often lead to undesirable fiscal consequences.STI successfully concludes a two-week course on Macroeconometric Forecasting and Analysis The recently held Macroeconometric Forecasting and Analysis (MFA) course provided participants with advanced time-series econometric tools for economic forecasting and policy analysis. These ranged from univariate analysis techniques such as ARIMA, to multivariate tools such as VARs (reduced-form, structural, Bayesian and VECM), as well as Nowcasting and state-space analysis. Thirty officials from nineteen Asia and Pacific economies and one international organization attended the course. Participants’ comments: “The knowledge and skills acquired through this course are very relevant in implementing the FPAS in my country. Most importantly, these are applicable for the implementation of the QPM. Also, I will be able to use these set of skills and knowledge in providing sound policy analysis and advice to the Monetary Policy Committee to enhance their decision making. Furthermore, I will be utilizing these skills in conducting empirical research to support evidence-based policy in the Central Bank.” “The topics covered in this course are very useful in deepening my understanding and applicable to my work. The workshop exercises were very structured and helpful in enhancing my skills and knowledge on the econometrics methods covered in this course. I am looking forward to applying some of these learnings on the job.” “All modules were covered thoroughly with hands-on exercise by course instructors. The experience materially enhanced my knowledge of these topics. Furthermore, I am expecting to apply lessons from all the units in my day-to-day job.” (July 19, 2024) |

|

Fiscal analysis and forecasting Thirty-one officials from 16 Asia and Pacific countries learned about medium- to long-term fiscal planning, resource allocation, and fiscal forecasting to enhance fiscal sustainability, fiscal discipline, transparency, accountability, and credibility. Topics included fiscal rules and fiscal councils, fiscal multipliers, and how the fiscal sector relates to the rest of the economy. Participants commented: “I am delighted with the course content and learning methodologies.” “Excel exercises greatly enhanced my learning experience, as I was able to make connections to the lecture content in practice.” (July 12, 2024) |

Fiscal risks can be sizeable, and often lead to undesirable fiscal consequences. Thirty officials from ministries of finance, economic development and planning, treasuries, central banks, and a financial comptroller general office from 20 Asia and Pacific countries learned about key institutions that help governments better assess and manage fiscal risks. The course focused on analytical tools to implement a fiscal risk management framework. Participants comments: "Fiscal tools and fiscal transparency are really helpful to improve fiscal risk management." "Developing a Fiscal Risk Statement was my main takeaway for this course and I am very happy to implement this in my country." "The FRAT (fiscal risk analysis tool) session is the most interesting one for me because it helps me to identify which type of information I need to obtain in order to have at least a qualitative analysis." "All the sessions are helpful, especially the tools which can be used to prioritize risks into those that require mitigation." |

Singapore Seminar Series: Cyber Risk — A Growing Concern for Macrofinancial Stability Ms. Mahvash S. Qureshi, Assistant Director in the IMF’s Monetary and Capital Markets (MCM) Department and head of the Global Financial Stability Analysis Division, and Mr. Tomohiro Tsuruga, Senior Financial Sector Expert, presented the findings of the IMF’s latest Global Financial Stability Report (GFSR, https://www.imf.org/en/Publications/GFSR) regarding the threat to macrofinancial stability posed by cyber risk. The seminar was hybrid – both in-person and online. Mr. Aleš Bulíř, STI’s Deputy Director, gave opening remarks, and Ms. Natalia Novikova, the IMF’s Resident Representative in Singapore, moderated the Q&A session. As Mahvash and Tomohiro showed, malicious cyber incidents are rising across the globe, with a notable expansion in cyber extortion causing increasing financial losses. The audience raised many interesting questions, such as the role of state actors in the attacks and the possible impact of generative AI in cyberspace. We thank the speakers and participants and hope to see you in one of our next seminars! A recording of the seminar is available here: Recording (June 11, 2024) |

|

High uncertainty and high levels of debt require prudent fiscal policy. Twenty-nine officials from ministries of finance, economic affairs, treasuries, central banks, and an office of the comptroller and auditor general from 18 countries applied key concepts, definitions, and techniques to assess fiscal sustainability using an Excel-based Public Debt Dynamics Tool (DDT). Participants commented: “Fiscal sustainability is a valuable course that enhances the ability to develop MTFF (medium-term fiscal framework) and MTDS (medium-term debt strategy). Moreover, the course helps learners build a reasonable scenario to measure a possible fiscal risk in country.” “The DDT (debt dynamics tool) is a simple tool for producing debt projection in comparison to other tools.” “Learning about how natural disaster and climate change could impact on investments and debt dynamics will be important and give new perspectives to my working unit.” |

|

STI successfully concludes a two-week course on Macroeconometric Forecasting and Analysis The recently held Macroeconometric Forecasting and Analysis (MFA) course provided participants with advanced time-series econometric tools for economic forecasting and policy analysis. These ranged from univariate analysis techniques such as ARIMA, to multivariate tools such as VARs (reduced-form, structural, Bayesian and VECM), as well as Nowcasting and state-space analysis. Thirty officials from nineteen Asia and Pacific economies and one international organization attended the course. Participants’ comments: “The knowledge and skills acquired through this course are very relevant in implementing the FPAS in my country. Most importantly, these are applicable for the implementation of the QPM. Also, I will be able to use these set of skills and knowledge in providing sound policy analysis and advice to the Monetary Policy Committee to enhance their decision making. Furthermore, I will be utilizing these skills in conducting empirical research to support evidence-based policy in the Central Bank.” “The topics covered in this course are very useful in deepening my understanding and applicable to my work. The workshop exercises were very structured and helpful in enhancing my skills and knowledge on the econometrics methods covered in this course. I am looking forward to applying some of these learnings on the job.” “All modules were covered thoroughly with hands-on exercise by course instructors. The experience materially enhanced my knowledge of these topics. Furthermore, I am expecting to apply lessons from all the units in my day-to-day job.” |

|

Thirty officials from statistics offices, central banks, and ministries of economy and finance from 13 Asia and Pacific countries learned about high frequency indicators of economic activity (HFIEA). The focus was on economic growth measured by gross domestic product (GDP), which is widely used by analysts, politicians, media, business community, and public at large as a summary, global indicator of economic activity and welfare. |

Delighted to have hosted the launch event for the IMF Paper on Housing Market Stability and Affordability in Asia-Pacific! DMD Li: "House price valuations are stretched in Asia-Pacific and house price cycles are turning. Countries in the region need to deploy multifaceted policies to address stability and affordability issues. Read the paper (link) and watch the replay of our discussion." |

|

| Excellent discussions with Asian Central Bank Governors, ECB President Lagarde, and Professor Larry Summers on the current economic context and the way forward at the SEACEN-IMF-STI High Level Event in Siem Reap, Cambodia (December 5, 2022) |

| STI Expert Webinar and Remote Training Video Come join us in our COVID-19 expert webinars and remote training! |

| STI Festive Greetings Video Watch a video from the STI and Singapore Resident Representative Office. |

| Fifth STI Directors of Training Meeting (February 28 - March 1, 2019) |

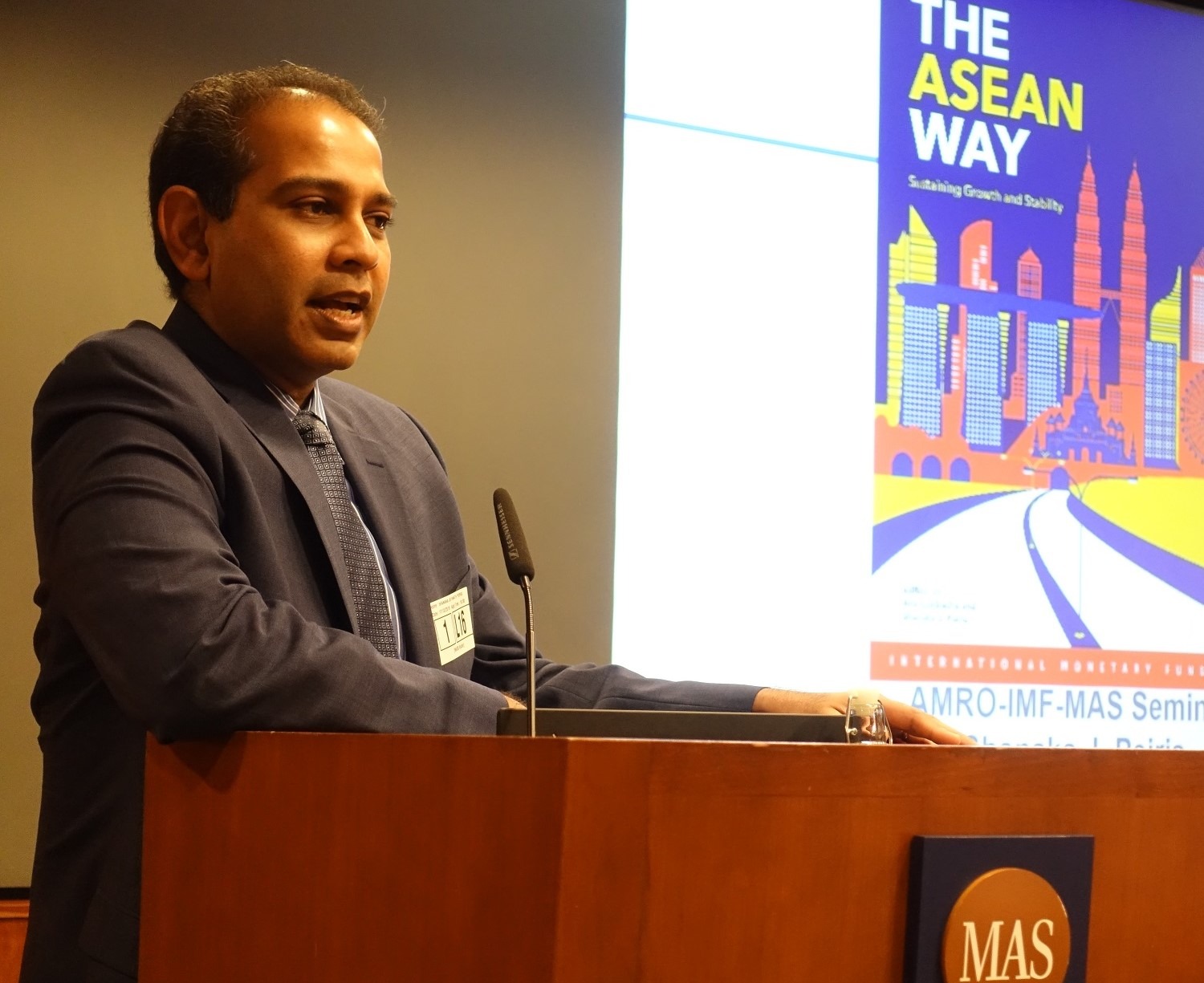

The IMF Book “The ASEAN Way” was launched at a seminar, jointly organized by AMRO, IMF and MAS on 17 Dec. The book analyses the economic and policy transformation of the ASEAN-5 economies (Indonesia, Malaysia, the Philippines, Singapore, Thailand) after the Asian Financial Crisis and how a variety of global risks will continue to test the group and their economic resilience. Shanaka Jayanath Peiris (IMF), Hoe Ee Khor (AMRO), Keen Meng Choy (MAS) and Ramkishen S. Rajan (LKY School of Public Policy) discussed how the ASEAN-5 economies will rise to the challenges ahead which call for upgrading policy and institutional frameworks, exploiting policy synergies and reaping the benefits of regional integration.

|

|

| Seminar and Book Launch (December 17, 2018) |

Participants at the IMF – STI’s Monetary Policy course (Nov 5-16) not only had the chance to simulate policy responses under different monetary policy and exchange rate regimes, they also visited the Singapore Fintech Festival.

|

| Participants of the STI Monetary Policy course visit Singapore Fintech Festival (November 12-16, 2018) |

A High-Level Peer-to-Peer Forum for ASEAN Countries, jointly organized by the IMF, Monetary Authority of Singapore and the STI was held in Singapore on July 9-10, 2018, to discuss monetary policy design and implementation. Senior officials and IMF and international experts in attendance at the interactive sessions concluded that upgrades to policy frameworks in Asia are needed to meet current global challenges.

Please see Professor John Taylor’s Keynote Speech → Link

|

|

|

| Modernizing Monetary Policy Frameworks in ASEAN Countries (July 9-10, 2018) |

“What was most useful was being in a room with other colleagues because it not only tested our knowledge but expanded it as well. The case studies were relevant and really applied to what we learned in the lectures.”

“I liked it when we used to have the case studies after each lecture for it helps a lot to furthermore understanding of how to apply these concepts and methods to whatever situation we have in our own countries. It’s better this way.”

Participants’ Comments

Participants of the Government Finance Statistics, April 2019

“Thank you for the two week MDS Course. It is very useful in many ways: it is more practical since there are workshops following each lecture. The lectures cover all sectors in the economy and emphasize the linkages between them. That is how we can conduct proper macroeconomic diagnosis. Lecturers are very experienced. I am confident that I will be able to apply the techniques and concepts I learnt from this course, to the context of Cambodia economy.”

Mon Sreyleak

Section Chief, National Bank of Cambodia, December 2018

“I was privileged to have joined the course on Macroeconomic Diagnostics in Siem Reap during the last 2 weeks. It is actually an eye-opening training course, equipped with useful tools for detailed analysis of each main sector in the economy. As a policy maker, this tool is very important in keeping me informed of the condition of an economy and where necessary, introduce the most suitable policy/remedy to bring the economy back on track.”

Narin Kruy

Deputy Director, Ministry of Economy and Finance, December 2018

“I would like to take this opportunity to appreciate the IMF team in their excellent performance. The role playing was very impressive and very close to the reality.”

“With this seminar, I have learnt about so many relevant areas of my work which I can take back to my country and share with my colleagues and try implementing for the improvement.

“I liked the lecturers’ way of presentation as they made it as simple as possible for us to understand while also delivering the advanced topics.”

“I would say the sessions on risk management, audit committee and the internal audit part were most useful to me as we are still struggling with the revision of our charters. The course made me understand much about the structure and reporting procedures and compositions.”

Participants’ Comments

Participants of the Safeguards Assessments of Central Banks, October 2018

“The High-Level Peer-to-Peer Forum on Monetary Policy in the ASEAN countries held in Singapore on July 9-10, 2018, was an extraordinarily well-organized and effective event. Representatives from ASEAN central banks gave detailed and transparent policy presentations on their different approaches to inflation targeting. The exchange of views (with the IMF and other international experts)—whether related to upcoming global challenges or local policy implementation—represented genuine progress toward improved monetary policy in the region.”

Please see Professor John Taylor’s Keynote Speech → Link

Professor John B. Taylor

Stanford University and The Hoover Institution, Keynote Speaker and Forum Participant (July 10, 2018)

The IMF Institute for Capacity Development (ICD) was established in 1964 to provide training in economic management to officials of the IMF’s member countries. Training is delivered at IMF Headquarters in Washington, D.C., through IMF regional training centers, in collaboration with other regional training institutions and national governments, and through online courses in partnership with edX. ICD is pleased to introduce our improved curriculum which is a result of a detailed review and redesign of the IMF course offerings with the aim to complement and enhance the IMF’s work. The new program better integrates with members’ needs and the IMF core mandate by clarifying course objectives, sharpening the focus of courses, minimizing overlaps, and establishing clearer sequencing across courses while also introducing new material.

The IMF’s partners in Asia tell the story of how the IMF – Singapore Regional Training Institute helps boost the economic policymaking capacity of countries in the region.

“Policymaking has become more complex and multifaceted, so policymakers need to have the requisite skills, knowledge, and judgment to be able to deal with this complex global environment. Hence the importance of capacity development in the region.”

Leong Sing Chiong

Assistant Managing Director, Monetary Authority of Singapore

“The Directors of Training Meeting is a useful platform for all heads of training institutions to discuss pertinent issues related to capacity building, and to review how the STI can better meet the demand for specialized economic and financial courses in the Asia-Pacific region.”

Heng Aik Yeow

Director-General, Technical Cooperation Directorate, Ministry of Foreign Affairs, Singapore

“The IMF is a world thought leader in fiscal and monetary policy; however, it’s also a neutral thought leader. It doesn’t provide you with the Japanese view, the American view, the European view, or the Australian view. It provides you with a global view that’s made up of every one of its member states. So it’s mutual, it’s based on partnership. It’s not telling you what to think: it’s exchanging ideas.”

Michael Feller

Third Secretary, Economic, Australian High Commission, Singapore

“Old schools of thought should not be thrown away, but we need to keep abreast of new developments.”

Naomi Kedea

Director, Human Resources Department, Bank of Papua New Guinea

“The training courses reflect the IMF’s own experience globally. That’s why their courses are important to us — the IMF’s global presence makes training, I think, far more effective than that of other organizations.”

Visakha Amarasekere

Director, Department of External Resources, Ministry of Finance, Sri Lanka

“At the STI, learning is not just in the classroom, but also through the interactions and the sharing of experiences with the participants. That is something our employees really value.”

Iñigo Regalado

Deputy Director, Bangko Sentral ng Pilipinas Institute, Bangko Sentral ng Pilipinas, Philippines